The tax return with Elster Online offers a simple way to submit tax data to the tax office. You can find instructions here.

Registration with Elster Online: Instructions

In addition to the “Elster Online” portal, there is also the “Elster Form”. The latter is more of a software that allows you to create your tax return offline.

- Registering with Elster Online is the first step to submitting your tax return digitally. This process secures your access to the online portal and ensures that your data remains protected. Registration only takes a few minutes but requires some important information. Open the Elster website and click on “Create user account”. You will be guided through the registration process, where you must provide personal information such as your name, address and tax ID. It is necessary to provide an email address to which an activation code will be sent.

- After you have received the activation code, enter it in the Elster portal to complete the registration. Create a secure password and choose a security question that can be used to recover your account if necessary. Optionally, you can also download a certificate that increases the security of your account. ElsterSmart gives you the option of saving the certificate file in an app on your smartphone. After these steps are completed, you can log into your new Elster account. For future logins, you will use your email address and password to access the portal.

- The registration process ends with confirmation of your identity, which is sent by post. Within a few days, you will receive a letter with another code that you must enter in the Elster portal to complete your registration. You can only use all of Elster Online's functions once you have entered this code. This step ensures that your identity has been recorded correctly and that you can submit your tax data securely.

- If you encounter any problems during registration, you can contact Elster Support. The website also contains a wealth of help that answers frequently asked questions and provides step-by-step instructions. You should also make sure that your internet connection is stable in order to complete the registration process without interruptions.

- As soon as registration has been successfully completed, you will have full access to all of Elster Online's functions. You can now start preparing your tax return or view and edit data that has already been submitted. This completes the first step towards a digital tax return.

Fill out your tax return online

After successfully registering with Elster Online, you can start filling out your tax return.

- To do this, you need to record your financial data from the last year correctly and have all relevant documents to hand. The online form guides you through the individual steps of your tax return and supports you with explanations and assistance.

- Log in to your Elster account and select the option “Create tax return” to start the process. You will be asked to select the tax year for which you want to submit the return. The form will then open, which you fill out systematically. First enter your personal details, followed by your income from various sources such as salary, rental income or capital gains. Make sure that all information is correct to avoid queries from the tax office.

- In the next step, you enter your expenses and deductions that can be claimed for tax purposes. These include advertising costs, special expenses and extraordinary expenses. Elster Online offers a help function that explains which expenses are deductible under which circumstances. Use this function to make sure that you enter all possible deductions and do not overlook anything.

- After you have entered all the data, Elster Online checks your tax return for possible errors or discrepancies. If the system detects any irregularities, you will receive appropriate information and can correct the entries. This automatic check will help you to submit your tax return without errors. If everything is correct, you can prepare the return for submission.

- Before you submit your tax return, you have the opportunity to check all the information again and make changes. You can also have a preliminary calculation of the expected tax liability or refund carried out. This calculation gives you an idea of what you can expect after the tax office has processed it. After you have checked the data, you submit the tax return electronically.

Complete and submit your tax return online

Completing your tax return in Elster Online includes the final check and electronic transmission of your data to the tax office.

- This step is important to ensure that your report is accurate and complete. Once you have reviewed all the information, you can begin the filing process.

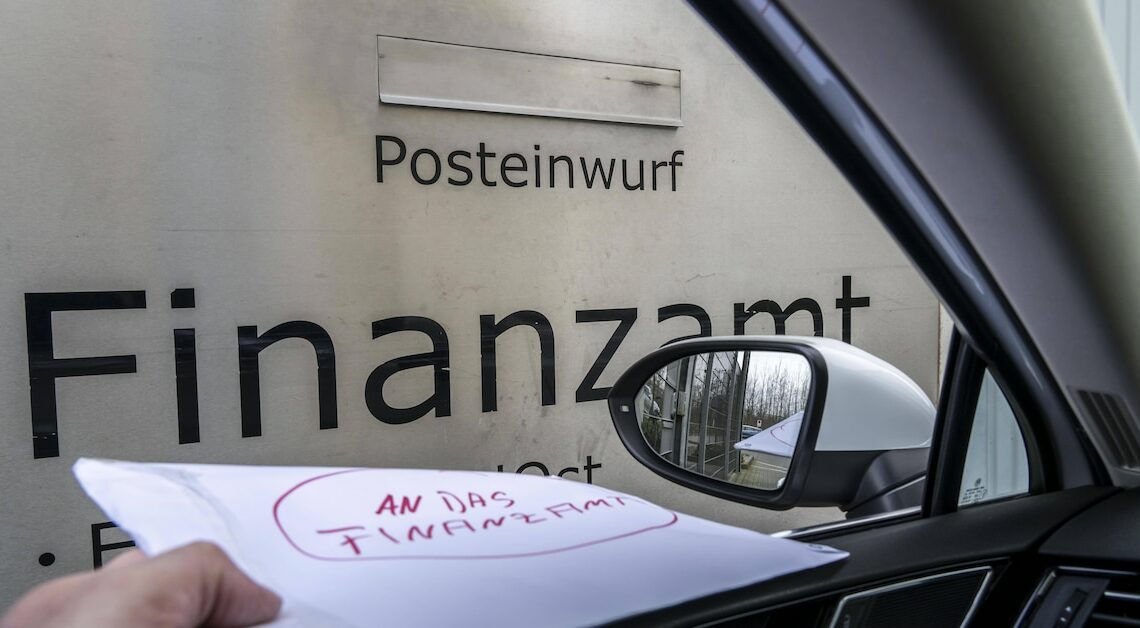

- Click on “Submit declaration” and choose whether you want to submit the tax return with or without an electronic signature. If you use a signature, you must use the certificate you downloaded previously. Without a signature, you can submit the declaration electronically, but you must also send a signed compressed printout of the declaration to the tax office. This option is useful if you do not have an electronic signature.

- As soon as you have submitted your tax return, you will receive confirmation that it has been successfully submitted. Keep this confirmation as it serves as proof that your tax return has been received by the tax authorities. The confirmation also contains an identification number that you can use to track the status of your tax return online. You can use this number to view the processing status of your tax return at any time in the Elster portal.

- After you have submitted your tax return, you can expect it to be processed by the tax office. Depending on how busy the tax office is and the complexity of your tax return, this can take a few weeks. In the meantime, have your receipts and proof ready in case the tax office requests further documents. You can then submit these quickly.

- As soon as the tax office has processed your tax return, you will receive a tax assessment notice. This will be sent to you either electronically via the Elster portal or by post. Check the notice carefully to make sure that all information is correct. If there are any discrepancies, you have the opportunity to lodge an objection within one month.

- A tax program such as WISO Steuer or Quick-Steuer helps you prepare your tax return and offers an interface to Elster.